MileBucks - Free Automatic Mileage Tracker & Log For IRS Tax Deduction app for iPhone and iPad

Developer: Hype Reactor, Inc.

First release : 27 May 2015

App size: 9.2 Mb

Want to save on taxes? You can be deducting your business miles! The IRS lets you deduct 57.5 cents for each business mile driven. Great for if your employer does not provide reimbursement for using your personal vehicle.

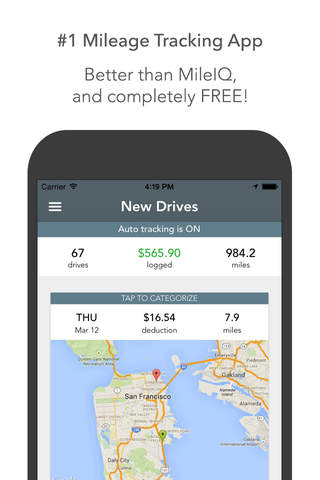

MileBucks Mileage Tracker saves you time and hassle by automatically tracking your drives and calculating the eligible deduction. Better than MileIQ and best of all, its FREE!

You dont even have to take your phone out of your pocket!

• Propriety smart drive detection technology automatically tracks and logs your drives

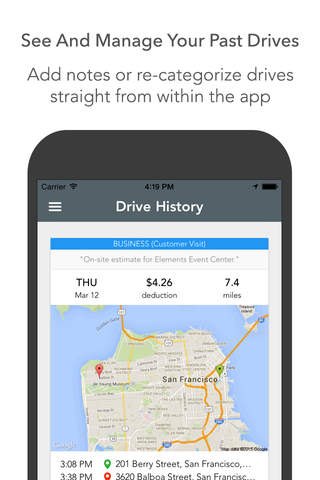

• Manage your past drives directly from within the app

• Get reports sent to your email

Great for real estate agents, independent professionals and contractors, lawyers and legal professionals, sales, Uber & Lyft drivers, and delivery drivers.

MILEBUCKS MILEAGE TRACKER IS ABSOLUTELY FREE!

Battery Consumption Note

Continued use of GPS running in the background can dramatically decrease battery life. MileBucks uses iOS GPS to an absolute minimum to minimize the impact on battery life.